We recently informed you that 2017 monthly gross minimum wage has been raised to 1.777,50 TRY with an about 9% wage hike, starting from 1st January 2016, while it was 1.647,00 TRY last year.

We recently informed you that 2017 monthly gross minimum wage has been raised to 1.777,50 TRY with an about 9% wage hike, starting from 1st January 2016, while it was 1.647,00 TRY last year.

In Turkey, minimum wage is a key determinant of many payroll parameters and employers’ labor cost.

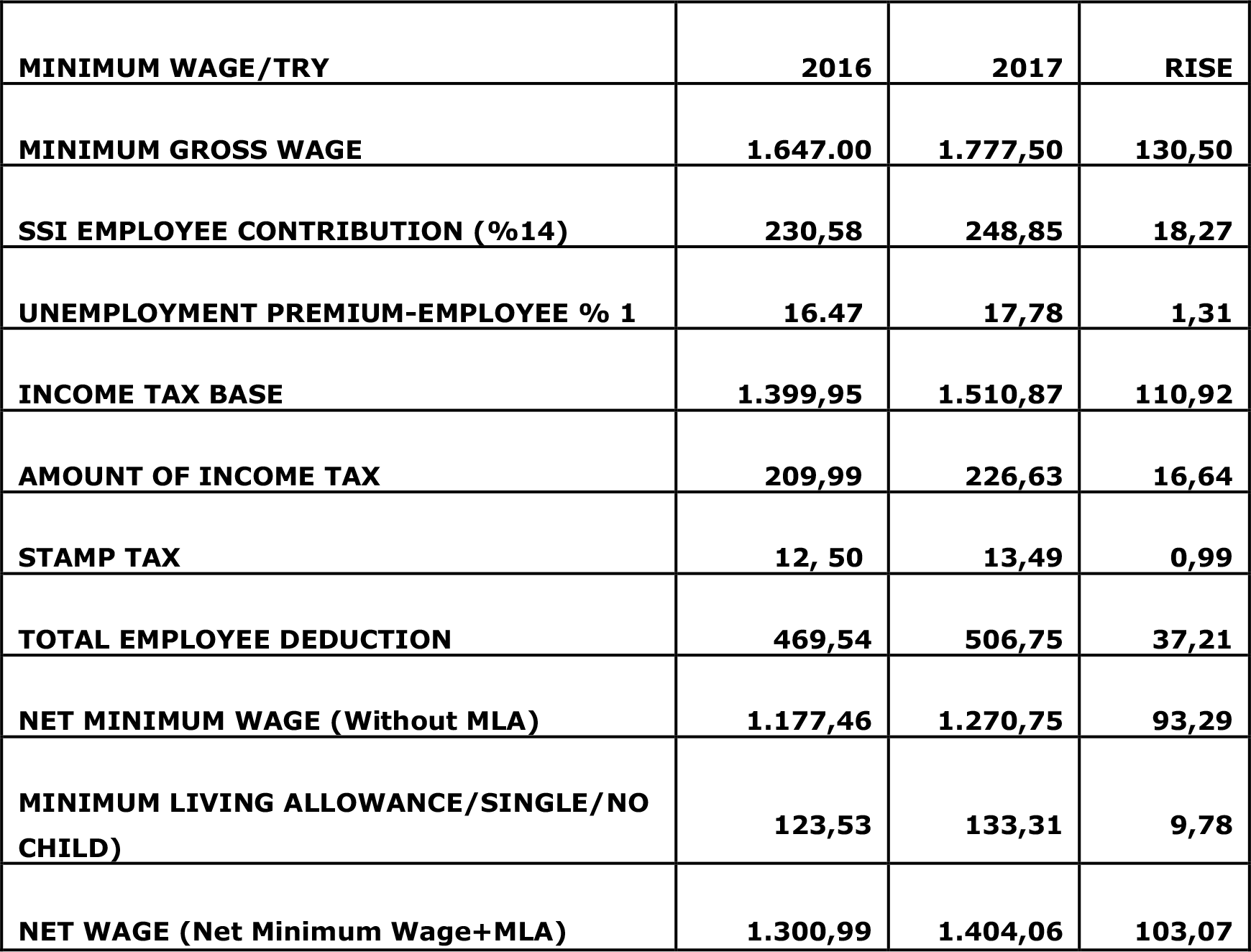

In the tables below you can see the calculation of minimum wage, and the cost of employer arising from minimum and maximum wages subjected to SSI premiums.

Calculation Of Minimum Wage

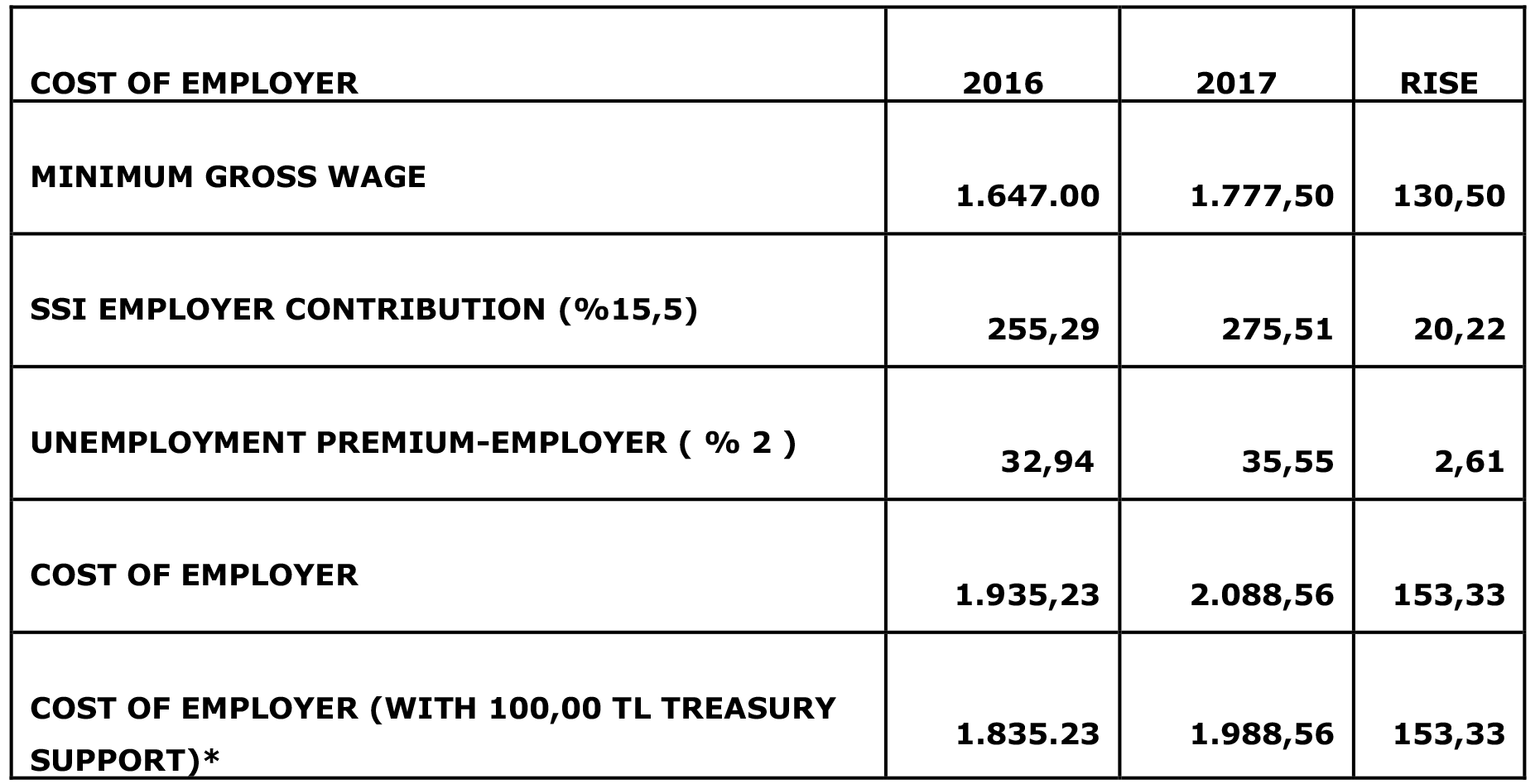

Labor Cost of Employer

Employer’s labor cost consists of gross wage to be paid to employee plus employer share of SSI premiums and unemployment premium paid to related government institutions.

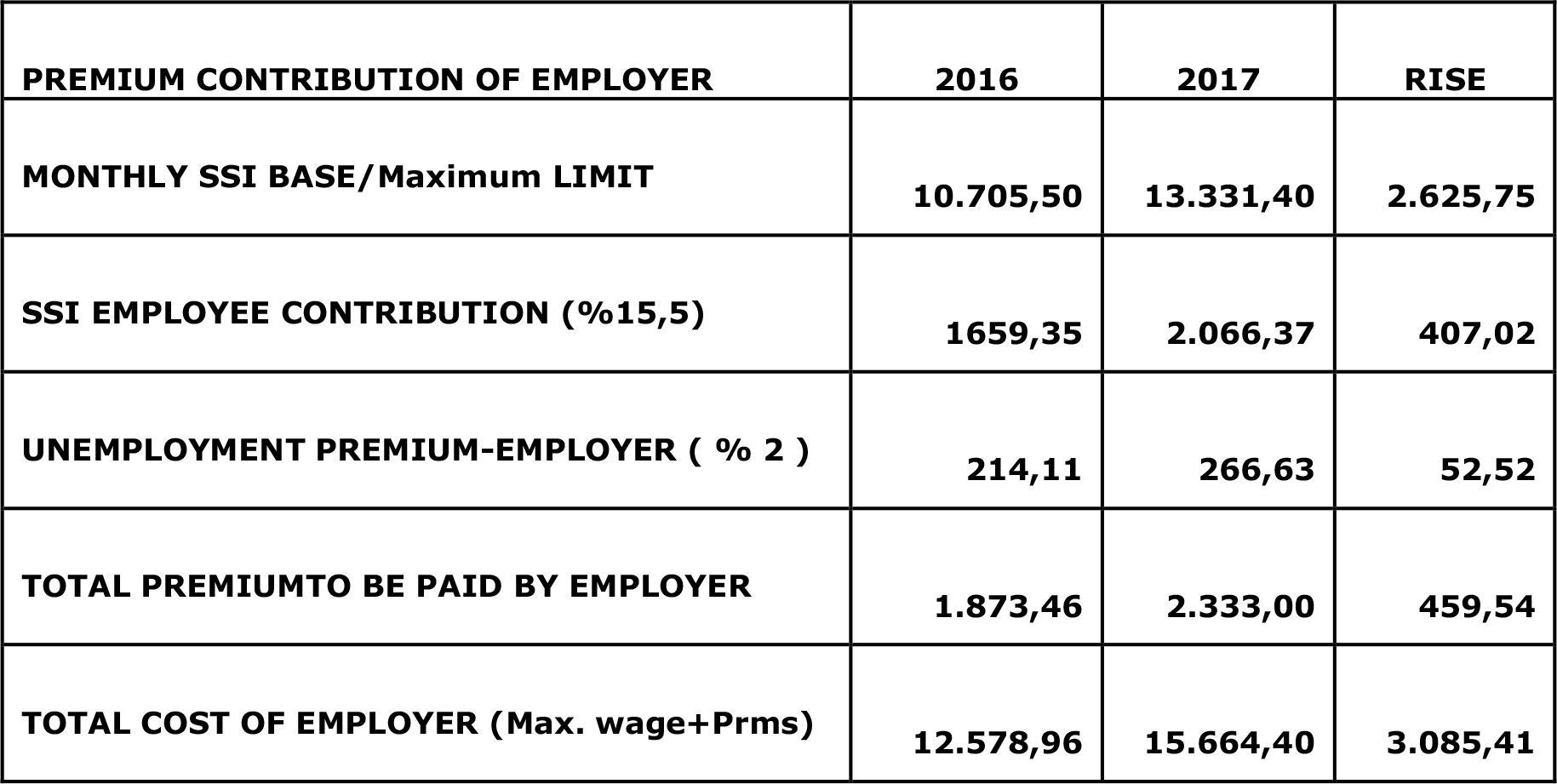

There is a limit as to the employees’ wages (earnings) subject to SSI premium, as it is seen below both employees’ and employers’ SSI contributions labor doesn’t change over a certain amount.

Also we are taking into account the government’s pledge as regard to minimum wage support will continue through 2017.

*Employers will be receiving daily 3,33 TL, (monthly 100.00 TL) premium refund throughout 2016 for each worker whose wage (earnings subject to premium) were notified under daily gross 85 TL (monthly gross 2.550.00 TL) in 2015, and for each personnel employed in new enterprises established/registered within 2016. This refund expected to continue during the 2017; however support amount will probably be changed.

Cost of Maximum Wage Subject To Premium

Cap of earning subject to premium were calculated as 6,5 times of daily minimum wage, but the this rate is increased to 7,5 times, i.e 7,5*1.777,50=13.331,25 TRY.

Turkish Labor Law

Turkish Labor Law